Updated “Corona forecast for the printing industry”: development of GDP and insolvencies

In August 2020 Apenberg & Partner issued the “Corona forecast for the printing industry”. We update this forecast with ACTUAL data from 2020, ACTUAL data from Q1 2021 and an adjusted outlook for the current year 2021. Almost one year later, it can be seen that the course has not been exactly as forecast. Nevertheless, a comparatively similar development can be seen.

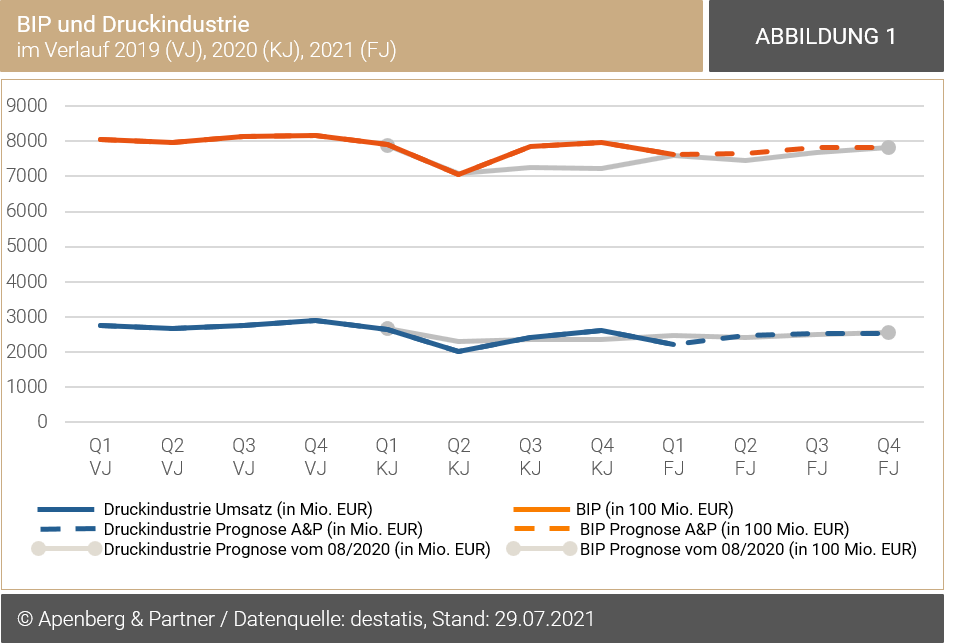

The graph shows the development of turnover in the printing industry in the years 2019-2021 in million euros (blue line) and GDP in 100 million euros (orange line). The previous year 2019 (PY), crisis year 2020 (PY) and the following year 2021 (PY) are considered. The forecast is represented by a dashed line in each case.

The graph illustrates that the relationship between GDP and print industry turnover has remained relatively stable through the crisis. In Q1 2020 (CY), due to the spread of the Corona pandemic in Europe, a significant drop in print industry turnover and GDP can be seen. While the forecast from 08/2020 assumed a flatter fall in sales for the printing industry, GDP in the first quarter of the crisis year was virtually exactly as forecast. A significant difference between the forecast from 08/2020 and the actual course in 2020 becomes apparent in Q3 and Q4 of the crisis year. Here GDP recovered faster and more strongly than forecast and the printing industry also recorded higher sales than expected.

In Q1 2021, the actual data for GDP and the printing industry return to the forecast level – in the case of the printing industry, the actual values even slip slightly below the forecast level.

As was already the case for the August 2020 forecast, Apenberg & Partner has again drawn up the turnover development of the printing industry for 2021 in relation to the GDP development. For the forecast of GDP Apenberg & Partner is guided by the forecast of 14 renowned economic institutes, which expect an overall increase of 3.44 per cent for 2021.[1] For the course of 2021 during the year Apenberg & Partner has used the year 2019 as a reference for the development of quarters two to four. The forecast for 2021 thus builds on the ACTUAL values from Q1 2021 and distributes the remainder of the GDP volume predicted for 2021 over the three remaining quarters. As in the previous forecasts, Apenberg & Partner has projected the course of sales development in the printing industry based on the average share of sales in the printing industry in GDP from the previous quarters. The largely parallel progression of the two curves (print industry and GDP) through the crisis year 2020 confirms our approach. By the end of 2021 GDP and the printing industry are expected to reach the volumes forecast in 08/2020.

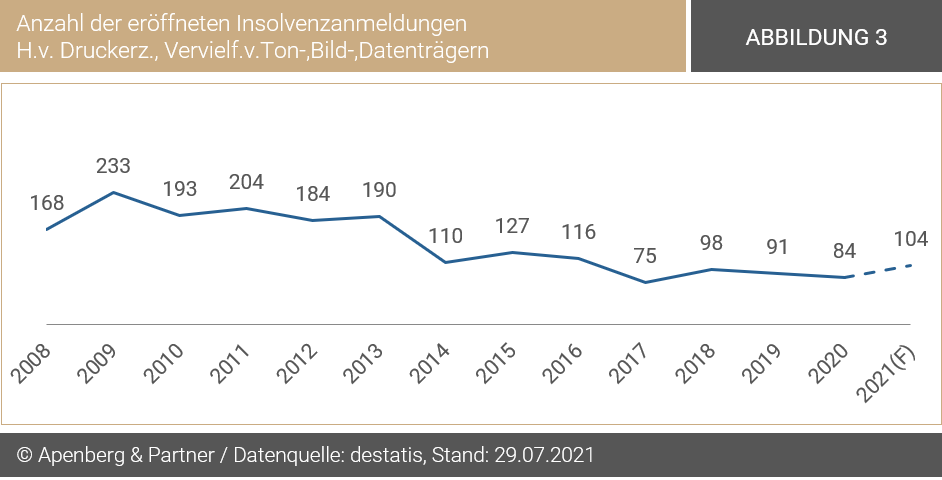

In connection with the development of turnover in the printing industry, Apenberg & Partner has also forecast the insolvency trend for 2020.

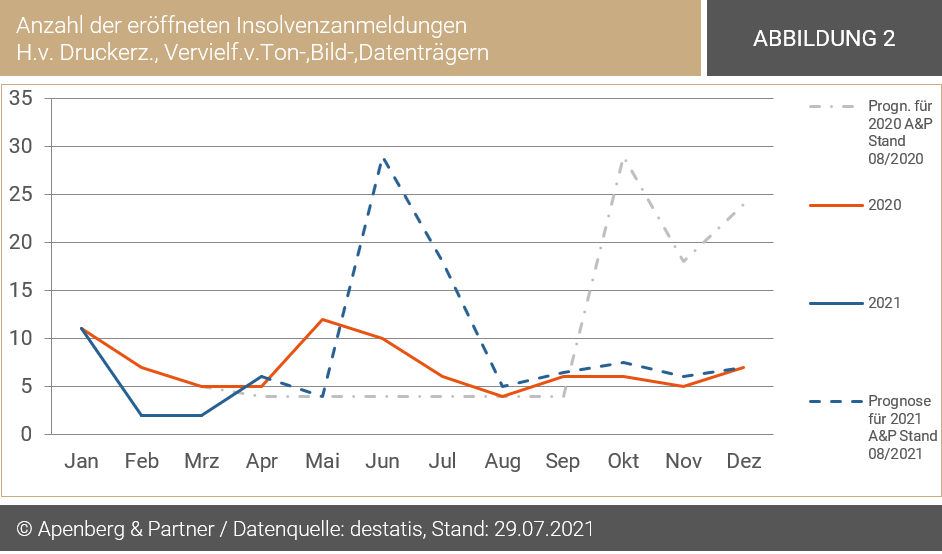

Figure 2 shows the opened insolvency filings in the monthly progression January to December for the years 2020 (orange line), forecast 2020 (grey line), 2021 (blue line) and forecast 2021 (dashed blue line). With regard to the ACTUAL data and the forecast, only opened insolvency filings are considered. Insolvency applications that were rejected for lack of assets are not taken into account.

Apenberg & Partner forecast a stagnating trend in insolvency filings for March to September 2020. The background to this expectation was the massive easing of insolvency filing requirements by the German government (see also Blog Post: Corona forecast for the printing industry). In contrast, a high increase in insolvencies was expected for October, as at the time the forecast was prepared (08/2020) the suspension of the insolvency filing obligation continued until 30 September (1.extension). With regard to the worsening situation, such as the occurrence of the lockdown in autumn and the disruption of supply chains, the obligation to file for companies that were over-indebted but not insolvent was extended again until 31 December 2020 (2nd extension). If assistance was still outstanding for the months of November and December 2020, the application obligation was extended until 30 April 2021 (3rd extension). There was no further extension.[2]

Already in the first quarter of 2021, there are 15 insolvency applications opened. In addition to the high increase in insolvencies in January (11), the months of February and March are very low with two insolvency filings each. For the months of May to July 2021, Apenberg & Partner expects an increase in insolvency filings, as the suspension of the insolvency filing obligation will cease at the end of the 3rd extension. The market is expected to recover at the end of the 3rd quarter and in the 4th quarter, so that the number of insolvency filings will stabilise by the end of the year. Overall, Apenberg & Partner assumes that insolvencies will continue to rise. A total of 104 opened insolvency applications are expected for the current year.

[2] Quelle: Bundesministerium der Justiz und für Verbraucherschutz (bmjv), „Aussetzung der Insolvenzantragspflicht“